There are prescribed forms through which the income earned by a person and the income tax paid thereon are informed to the Income Tax Authority. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to.

2019 Income Tax Calculator Factory Sale 57 Off Www Ingeniovirtual Com

Even if your income is below the taxable bracket you should file your income tax returns.

. There are various ways to get exemptions on the taxable income for individuals who fall under the exemption bracket offered by the Government. PPF Interest Rate in India for 2019. Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the thresholds set for the 37 ordinary tax rate.

The tax rate on long-term gains was reduced in 1997 via the Taxpayer Relief Act of 1997 from 28 to 20 and again in 2003 via the Jobs and Growth Tax Relief Reconciliation Act of 2003 from 20 to 15 for individuals whose highest tax bracket is 15 or more or from 10 to 5 for individuals in the lowest two income tax brackets whose highest. Chargeable Income RM Calculations RM Rate Tax RM 0 5000. Non-individuals have a lower income bracket but have higher withholding rates.

Individual income tax rates residents Financial years 201819 201920. RinggitPlus Malaysia Personal Income Tax Guide 2020. Here are the income tax rates for personal income tax in Malaysia for YA 2019.

Find tax saving investments under 80c to 80u of income tax act of India. Tax exemption for individuals earning less than P250000. If the gross income is higher than P720000 a 15 withholding tax based on the gross income should be applied.

RinggitPlus Everything you should claim as Income Tax Relief. PPF Interest Rate in India for 2019. All That You Need To Know.

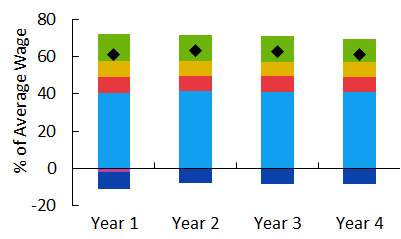

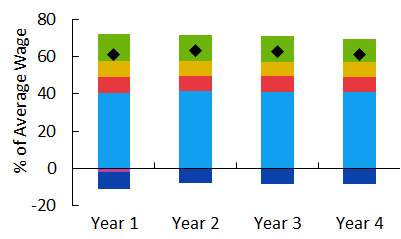

CompareHero 7 Tax Exemptions in Malaysia to know about. The GoBear Complete Guide to LHDN Income Tax Reliefs. Chart 21 Composition of Australias Commonwealth and State and local taxes 2012-13 Note.

If the gross income for the year does not exceed P720000 then a 10 withholding is required. Detailed description of taxes on corporate income in Greece For the years 2016 through 2018 the contribution was calculated on a minimum 50000 United States dollars USD while for the years 2019 and 2020 a minimum contribution of USD 5000 was imposed on an annual basis increased to USD 6000 from 2021 onwards. Federal Taxes on goods services and activities includes the goods and services tax.

PPF or Public Provident Fund. Exceptions also apply for art collectibles and. On the first 5000.

Under the Australian System of Government Financial Statistics6 royalty income is not a form of taxation and is included in the property income category along with interest income and dividends. LoanStreetmy 9 Things to know when Doing 2019 Income Tax E-Filing. Taxable income Tax on this income Effective tax rate 0 18200 Nil 0.

PPF or Public.

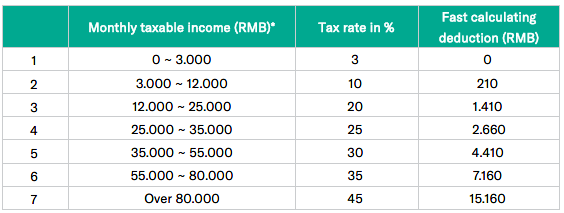

How To Calculate Foreigner S Income Tax In China China Admissions

Cukai Pendapatan How To File Income Tax In Malaysia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Oecd Overlooks Amazing Success Of Low Tax Singapore Urges Higher Taxes In Asia Cato At Liberty Blog

South Korea Earned Income Deduction Local Income Tax Kpmg Global

2019 Income Tax Calculator Factory Sale 57 Off Www Ingeniovirtual Com

2019 Income Tax Calculator Factory Sale 57 Off Www Ingeniovirtual Com

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

2019 Income Tax Calculator Factory Sale 57 Off Www Ingeniovirtual Com

Tax Identification Numbers In Laos Compliance By June 2021

Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

Jaguar Land Rover Profit Before Tax 2011 2021 Statista

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More

How To Calculate Income Tax In Excel

Tax Benefit Web Calculator Oecd

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax